When your clients are applying for a loan, one of the numbers they’ll see is an Annual Percentage Rate (also known as an “APR” or a “rate”). This blog post is your one-stop shop for everything rates-related — including what rates are, what factors affect them, and what rates your clients can expect to see.

What are rates?

Rates refer to the yearly cost of getting a loan. A client’s rate includes both interest and any unique fees the lending partner may charge for processing the loan (also known as “origination fees”.)

There are two types of interest rates: fixed and variable. With fixed interest rates, your client’s rates won’t change over the loan term. In other words, the rates they see when they apply for the loan are the rates they’ll see throughout the loan terms, regardless of how the market rates change.

Variable interest rates change over time. They are based on the economy’s average current interest rate (also known as the “current market rate” or “prevailing interest rate”). Any change to the current interest rate would affect the rates your client is paying each month — for better or for worse.

What factors determine my client’s rates?

The rates clients see are dependent on a couple of factors, including their individual credit profile, whether the loan is secured or unsecured, and the type of financing you offer.

1) Your client’s individual credit profile is dependent on their Fair Issac Corporation (FICO) score, debt-to-income ratio, employment status, and other factors. Typically, clients with lower FICO scores see higher rates while those with higher FICO scores see lower rates. However, a high FICO score is not a guarantee your client will get favorable loan terms, nor is a low FICO score a guarantee your client won’t get favorable loan terms.

Tip: If you want to learn more about the individual factors that affect rates, you can check out The Contractor’s Handbook: Everything you need to know about personal loans through Hearth.

2) There are unsecured and secured personal loans. Unsecured loans, like those offered through Hearth, do not require any home equity. Because lending partners have nothing to seize if the applicant defaults on the loan, the interest rates they offer account for any risk of default. For that reason, clients may see higher rates with unsecured loans than they would with secured loans, which are backed by home equity or another sort of collateral,

Tip: For an overview of the financing terms you need to know — including “secured personal loans,” “unsecured personal loans,” “collateral,” and more, check out this glossary of terms.

3) Depending on the type of financing you offer, you may be covering your client’s rates. If you offer Buy-Down Financing, you’re paying dealer fees to a third-party financing company in order to show your clients lower rates than they otherwise would’ve seen.

Hearth offers Profit Protection Financing, which means your clients don’t have to go through the hassle of going through a bank or another lending institution. You aren’t paying dealer fees to buy down your client’s rates. As a result, they may see higher rates than they’re used to seeing, because you, as a contractor, are no longer covering part of the loan.

Tip: Find out whether Profit Protection Financing is the right fit your business using The Contractor’s Handbook: How to pick the right financing option to grow your business

What rates can my homeowners expect to see?

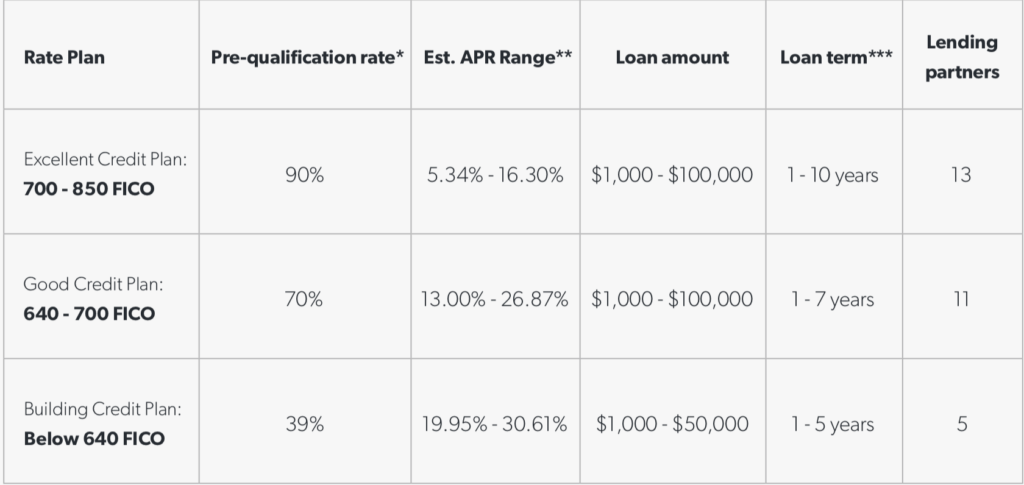

We know it can be frustrating when your client gets higher rates than expected. The chart below helps explain the rates clients can expect to see if you offer them Profit Protection Financing through Hearth. Note that the majority of clients will see options with APRs in the ranges listed below and some may receive options with higher or lower APRs.

Remember each lending partner has unique criteria when deciding what rates to offer. The same client could see two different rates from two different lending partners! Hearth allows your client to see options from up to 13 different lending partners so they can compare several options and pick their favorite one.

Conclusion

This blog post is not meant to tell you exactly what rates a specific client would see. Instead, it gives you a general overview on rates. As you sell with financing, you can use this blog post to help your client understand rates and know what to expect so that there aren’t any surprises — only signed contracts!

—

*For each self-reported credit score range, pre-qualification rate is calculated by dividing the number of pre-qualified Hearth users by the total number of users who submitted a loan request.

**For pre-qualified Hearth users with this credit score range, our lending partners returned loan options with this range of minimum APRs for the 65% of pre-qualified users with minimum APRs between the 10th and 75th percentiles.

***For example, a loan in the amount of $10,000 for a term of 5 years with an APR of 6.00% would be repaid over 60 monthly payments in the amount of $193.33.

Hearth is a technology company, which is licensed as a broker as may be required by state law. Hearth does not accept applications for credit, does not make loans, and does not make credit decisions. Hearth works with various lending partners to show customers available financing options; all loans subject to credit approval. Hearth is available nationwide, other than in Maryland, Nevada, North Dakota and Vermont.