Project Loans, powered by LendKey, is here! So, let’s learn more about Project Loans and how it benefits you and your customers.

- What can LendKey do for you and your customers

- What to Expect with Project Loans

- Tips on selling LendKey to your customers

- More Ways to Finance

What can LendKey do for you and your customers?

Lower Rates

Project Loans offers better APRs for qualifying customers since they’re more secure due to LendKey’s contractor approval process. Plus, some customers can get up to 20 years to repay the loan!

Get Paid Directly

With Project Loans, the money comes to you! These loans are specific to a project and the funds are sent directly to your business.

No Dealer Fees

Neither Hearth nor the lender will charge any dealer fees for the loans.

Larger Loans

With Project Loans, qualifying customers can get up to $125,000. More money means more opportunities to give your customers what they dreamt of.

What to Expect with Project Loans

To qualify for LendKey Project Loans you and your business must

- Be two or more years in operation

- Have a state or municipal license (if applicable)

- Have General Liability Insurance of at least $1MM

- Have zero company bankruptcies in last five years

- Have less than two lawsuits or judgments in past year

- Have zero personal bankruptcies in last two years

- Have no unsatisfied tax liens

- Have no criminal record

How does funding work?

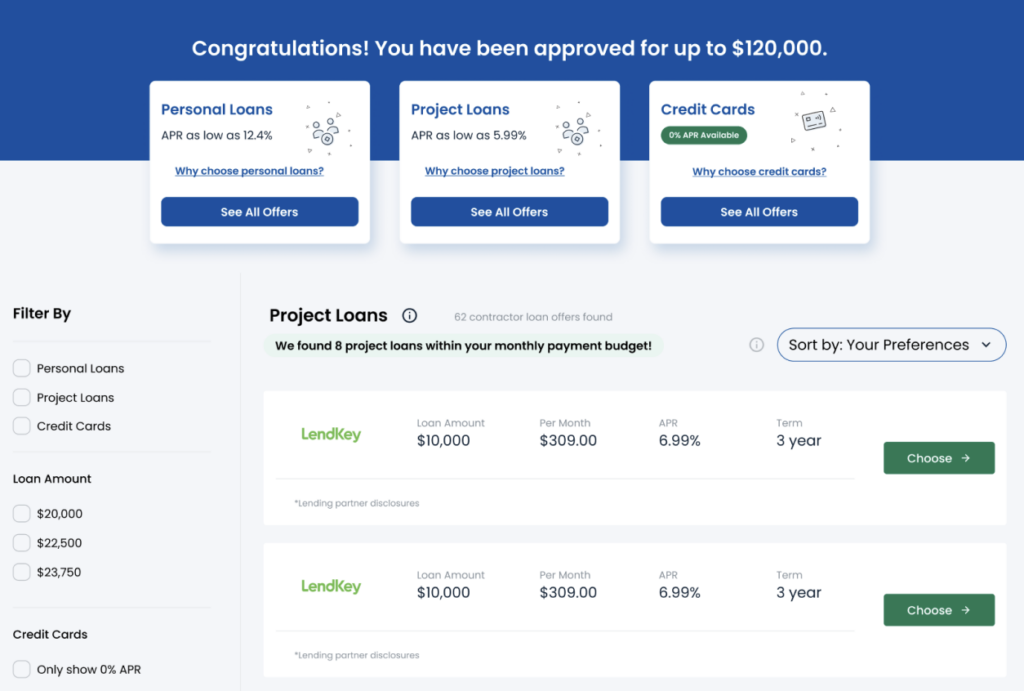

Unlike your current loan options for customers, Project Loans are funds paid directly to you, rather than your customers. Once you are approved to offer Project Loans, your customers will be able to select Project loans on their Offers page.

You will be able to request a disbursement for your project when funds are available. The money will then be sent directly to your account via ACH.

How do I get paid?

Once you’ve uploaded your project contract and started your project, you can request a payment disbursement made directly to you via ACH. The way you request a disbursement is from LendKey’s website.

If you forget how to get there, you can login to Hearth, go to the “Financing” tab and click on the client you’re requesting a disbursement from. When you click on the financing section under the client name, there will be a button, “Request Disbursement” that will lead you through the payment disbursement process on LendKey’s website.

Each customer reviews and approves each Disbursement Request in their online account. Once the request is approved, the status will be updated with “Disbursement in progress”.

How can my customers get approved for LendKey Loans?

Customers with FICO Scores of 750 and above have the best chance of securing a Project Loan from LendKey.

Does LendKey cost me money?

No, there are no sign-up fees, dealer fees, or annual minimums to meet to offer Project Loans to your customers.

Will this replace existing financing options my customers have access to today?

No, this will be an additional financing option (on top of your current loan options) for your customers. This gives your customers more options and flexibility to fund their project!

I was taken to a DocuSign, is that right?

Yes, that is correct. The LendKey application process is much like a traditional loan form. The prompts on the application should be clear, but if you need assistance, you can reach out to LendKey’s support team at [email protected].

Tips on selling LendKey to your customers

- If your business gets approved to offer LendKey, recommend it your leads and customers. Top of mind awareness goes a long way.

- LendKey, can make projects easier and less stressful. Your customer only needs to approve the work and funded amount meaning less stress about money transfers or finance based delays.

- Customers that choose LendKey gain access to their support team. It’s like having a friend to help with the finances.

Start offering project loans today!

Looking for more ways to finance? We got your covered.

New! Project Loans

Project loans are different from personal loans and credit cards. The funds are specific to a project and sent directly to your business. While it can be a longer application process on the contractor’s end, once secured, it can be very rewarding for all parties.

Personal Loans

Personal loans are like regular loans that anyone can get. While these loans may have higher interest rates and less job security your customers usually have more loan options which can increase your win rate.

Credit Cards

Credit cards can have high interest rates but, allow for the more spending flexibility, especially for smaller priced jobs.

If you are interested in offering financing solutions for your flooring business, contact Hearth today.

If you have any questions or feedback, please contact our support team. Thank you for choosing Hearth!