Even when our lending partners find payment options for your client, every once in awhile, the rates may not be what your client expected.

We know this can be a frustrating experience for both you and your client — we want to help you understand why this happens and what you can expect in the future.

Remember: With Hearth, you aren’t buying down your client’s rates. The rates clients see are typical for profit protection financing and may be higher than rates seen in contractor buy-down financing.

What factors determine the APR of a loan?

APR (annual percentage rate) refers to the annualized total cost of the loan, including any fees or additional costs of the transaction. Lending partners use several factors to determine APRs for the loan options they show to your client. Although many homeowners find APRs as low as 5.34% through Hearth, that isn’t the case for everyone. Here are some of the main things our lending partners consider when determining APRs for your client:

Credit score

A client’s credit score is determined by their credit history, debts owed, payment history, and more. Our lending partners use your client’s credit score to estimate their credit risk — or their likelihood of paying back a loan. In general, higher credit scores tend to lead to lower APRs, and vice versa.

Key point: While someone’s credit score can be useful for predicting eligibility and rates, a certain credit score is not enough to guarantee a certain APR. If a homeowner has a bad credit history, for example, our lending partners may decide to increase the APR on their loan options.

Loan term

The loan term refers to the time period over which a customer pays back a loan. A higher loan term (like 84 months) will result in lower monthly payments, but a higher APR and higher total cost to the client.

Debt-to-income ratio

If a homeowner’s debt-to-income ratio is high, our lending partners may offer a loan option with a higher APR than average for that credit score. Our lending partners may pre-qualify homeowners for options with higher APRs as their debt-to-income ratio approaches 40%.

Bottom line? Even from all of our data and testing, we can’t perfectly predict the APRs a customer will receive when they pre-qualify. Our lending partners offer client market rates — other financing partners often offset these with dealer fees, but Hearth contractors are never responsible for subsidizing a loan. Instead, we’ve created a broad network of lending partners that allows us to offer a range of extremely competitive options.

Next steps

What are we doing to improve financing options for your clients?

Hearth works with a network of 12 lending partners that each cater to different kinds of clients. When a client goes through Hearth, they are automatically considered by our network. This approach increases the odds that even a low-credit client will find competitive payment options that they like, and many clients are able to see many great options.

We take the privilege to serve your clients seriously. Here are the concrete steps we’re taking to increase the odds of pre-qualifying for options with low APRs:

-

Expanding our network of lending partners: We’re always adding more lending partners to increase the odds that your client finds at least one option they like.

-

Finding other financing options: We’re actively exploring other financing options for low-credit clients as a fallback if they don’t find an unsecured personal loan that fits their needs.

Your customer is upset that their APRs are high. What do you do now?

-

Reassure your client: Remind your customer that going through Hearth’s pre-qualification process didn’t affect their credit score, so their credit profile wasn’t damaged if they don’t proceed and fund their project through one of Hearth’s partners.

-

Let us help you: We’re here to walk your client through the pre-qualification process and explain their results. If after reading this article, you are still unsure why your client pre-qualified for the offers they did, give us a call and we’ll try to figure it out together.

What can you do differently for future clients?

We want you to know what to expect as you move forward. Here are things you should know as you try Hearth with your next client:

-

Keep using the product: The more you use Hearth, the more likely you are to get clients funded. Contractors that use Hearth with multiple clients dramatically increase their likelihood of making a huge return — and on average, contractors that fund just one extra project with Hearth make $42.40 for every $1 they spent on a Hearth subscription.

-

Use Hearth to qualify your clients: Our lending partners use market rates when pre-qualifying your client — so if they don’t find an option they like through Hearth, your client may have a difficult time finding a satisfactory personal loan anywhere. Use Hearth as a barometer for whether your client will be able to finance your project.

-

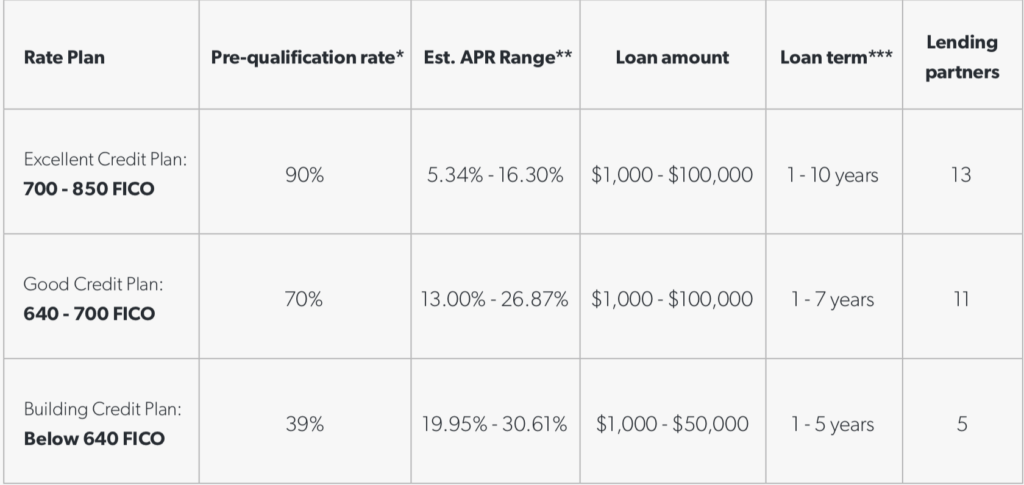

Set expectations: Make sure you set expectations before you have a client pre-qualify. If your client has low credit, tell them that Hearth may not be able to find payment options for them — and if they can, they may have high APRs. Use the chart below to calibrate your clients’ expectations:

We love working with our contractors and are committed to offering the best product to both you and your client. If you have any questions or want to discuss the best way to find financing for your client, give us a call at 512-686-4141.